30+ Fannie mae mortgage calculator

Extending the term of the mortgage eg from a 30-year term to a 40-year term Reducing the interest rate. In the US a conventional loan is a mortgage that is not insured by the federal government directly and generally refers to a mortgage loan that follows the guidelines of government-sponsored enterprises GSEs like Fannie Mae or Freddie Mac.

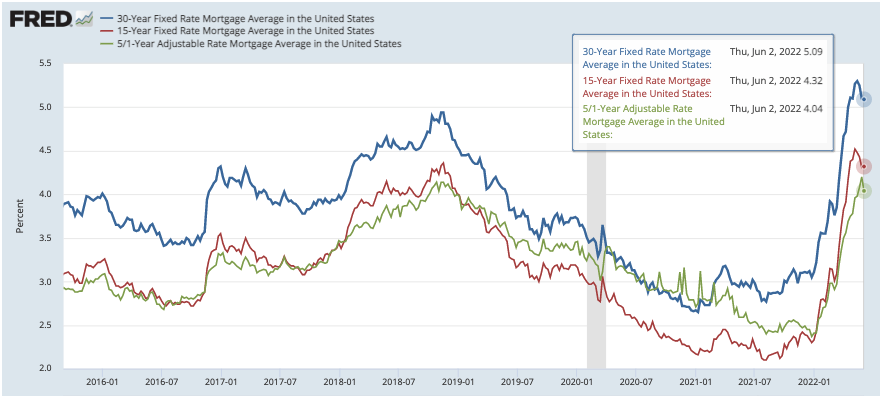

St Louis Interest Rates St Louis Real Estate News

Economy will contract next year federally backed housing giant Fannie Mae forecasts.

. A jumbo loan is used when the mortgage exceeds the limit for Fannie Mae and Freddie Mac the government-sponsored enterprises that buy loans from. The HomeReady mortgage includes innovative income flexibilities that can help your customers qualify for an affordable mortgage with a down payment as low as 3. Fannie Mae customers.

A loan is considered jumbo if the amount of the mortgage exceeds loan-servicing limits set by Fannie Mae and Freddie Mac currently 647200 for a single-family home in all states except Hawaii and Alaska and a few federally designated high-cost markets where the limit is. View 97 LTVCLTVHCLTV financing options that help you serve qualified first-time home buyers and support the refinance of Fannie Mae loans. Minimum Mortgage Requirements in 2022.

The federal government created several programs or government sponsored entities to foster mortgage lending construction and encourage home ownershipThese programs include the Government National Mortgage Association known as Ginnie Mae the Federal National Mortgage Association. Loan modifications and refinancing and which is best for you. Conventional loans may be either conforming or non-conforming.

Inman 082222 Carter Matt. Just this week Fannie Mae the government-sponsored buyer of home mortgages predicted the rate on the 30-year fixed mortgage will fall to an average 45 percent in 2023. In 1983 39 billion in additional stock was added.

A Fannie Mae HomePath property is a house thats being sold directly by Fannie Mae to an investor or a traditional buyer. 2021 2022 Mortgage Rate Housing Market Predictions Mortgage Rates. One is if the house has gone through foreclosure and Fannie Mae owned the mortgage on it.

While Fannie Mae only modestly cut its 2022 GDP outlook by 02 points to 21 to negative 01 from. Calculator and Quick Reference Guide. By 1984 ARMs accounted for about 60 of new conventional mortgages closed that year exclusive of FHA VA loans.

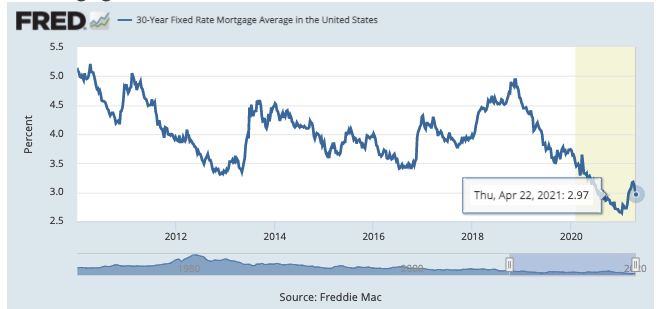

Saving money on your mortgage is always good. The index measures mortgage commitments Mtg Com for delivery del within 30 to 60 days. However Fannie Mae economists also believe mortgage rates have peaked and will trend downward into next year.

Current Mortgage Rates Home Loan Calculator Best Mortgage Lenders. On the week of November 5th the average 30-year fixed-rate fell to 278. Our mortgage calculator takes the price of the home and gives you an estimate of how much your property tax will be.

This service is provided for the sole purpose of showing the applicable Area Median Income AMI for each applicable census tract. The current PITIA and the proposed PITIA must be used in qualifying the borrower for the new mortgage loan. Contact your mortgage company or the Fannie Mae Mortgage Help NetworkTell them you are interested in learning more about a Modification and whether it might be the right solution for you.

Lender may use the AMI limits for purposes of determining income eligibility for RefiNow HomeReady or other loans that have AMI requirements. The Renters Resource Finder is provided for informational purposes solely as a convenience for renters in order to identify whether renters are eligible for assistance through Fannie Maes Disaster Response Network. Explore our calculator tools.

Updated December 17 2021. Meanwhile pending sales which lead closings by approximately 30 to 45 days on average fell 86 from May to June though by a much smaller 1 in July. There are two situations in which Fannie Mae ends up owning a house.

Loan volumes grew so quickly that Freddie Mac tightened lending criteria in 1984. Choose a longer-term mortgage like a 30-year rather than a 15-year loan. 2020 is expected to be a record year for mortgage originations with Fannie Mae predicting 41 trillion in originations and refinance loans contributing 27 to the total.

If you took a mortgage at 500000 for a 2-unit home it is considered a conforming loan. The mortgage industry of the United States is a major financial sector. 51 ARM 331.

Knowing key Fannie Mae guidelines will help you be prepared to get a conventional loan or refinance an existing mortgage. To give you a better idea lets say the conforming limit for a 2-unit house in your area is 702000. IRS Form 1040 Individual Income Tax Return.

Fannie Mae HomePath mortgage. Learn about two ways to save. Early in the repayment period your monthly loan payments will include more interest.

Every lender and investor in the loan such as Fannie Mae Freddie Mac FHA etc has their own standards when it comes to who qualifies for a modification and. A 30-year mortgage will repay at a different pace than a 15-year or 20-year mortgage. Fannie Mae Cash Flow Analysis.

That is the required net yield on mortgage loans that lenders sell to FNMA which in turn sells mortgage. The Calculator will open in a new browser tab. Suggested guidance only and does not replace Fannie Mae instructions or applicable guidelines.

As the lienholder Fannie Mae now owns the home. Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2. Please use the following quick reference guide to assist you in completing Fannie Mae Form 1084.

However if you exceed the 702000 loan limit your mortgage will classified as a non-conforming conventional loan. Youll need to show evidence of hardship. Fannie Mae makes no representation warranty or guarantee regarding the accuracy or completeness of the.

However Fannie Mae will not require the current principal residences PITIA to be used in qualifying the borrower as long as the following documentation is provided.

Calculated Risk May 2013

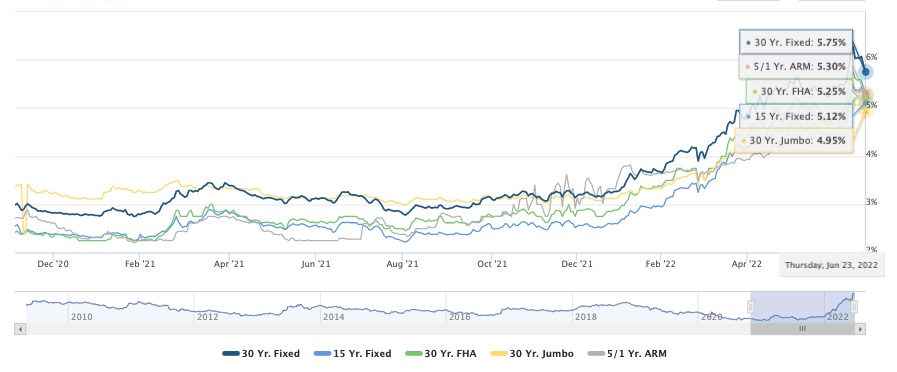

Your Adjustable Rate Mortgage Needs To Be Refinanced

If Mortgage Interest Rates Return To 5 7 Or 10 People Would Have A Lot Of Pressure Not To Move Or Refinance So How Would This Impact The Housing Market Quora

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

St Louis Interest Rates St Louis Real Estate News

Calculated Risk May 2013

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Dji Dow Jones Industrial Average Physik Invest

St Louis Interest Rates St Louis Real Estate News

Home Prices Dip For First Time Off Crazy Spike Price Reductions Surge Sellers Emerge House Sales Drop Year Over Year Inventories Supply Keep Rising Wolf Street

Dji Dow Jones Industrial Average Physik Invest

What Is The Income Required To Buy An 800k House Quora

Help Choosing To Buy Now Or Wait 2022 Housing Forecast

7 Pieces Of Homebuying Advice You Can T Afford To Ignore Home Buying Home Buying Process Home Buying Tips

Home Prices Dip For First Time Off Crazy Spike Price Reductions Surge Sellers Emerge House Sales Drop Year Over Year Inventories Supply Keep Rising Wolf Street

Calculated Risk May 2013

St Louis Interest Rates St Louis Real Estate News